Methodology:

This 2022 sports-betting report, Bettor perspectives: How organizations can win in the new world of Canadian sports betting, explores historical and future Canadian sports-betting behaviour, betting experiences, demographics, fandom, and cross-integration of casino games. These findings are based on an online survey (conducted from September 22 to

October 1, 2021) of more than 1,000 Canadian consumers aged 18 years and older, including likely bettors and non-bettors, from varying financial situations and geographical regions. All dollar figures quoted are in Canadian currency unless otherwise noted.

Canada’s federal government legalized single-event sports betting in late August 2021, allowing the provinces and territories to offer and regulate the activity as they see fit. It is hoped that the move will see the estimated $14 billion spent annually in illicit and unauthorized and poorly controlled markets redirected toward legal sectors, where it can be monitored and taxed appropriately. In Deloitte’s last report on sports-betting reform, New stakes in the game (February 2021), we estimated that legalizing single-event betting could result in $28 billion in legal-market wagers by five years post-reform.

To achieve this potential, governments, the gaming industry, media companies, and sports organizations should aim to understand bettors’ perspectives and behaviours in terms of single-event betting.Yet curiously, bettors’ voices have largely

been absent from conversations about this important evolution of the Canadian sports, entertainment, and gaming sectors.

We intend to bring bettors’ voices into the discussion with this report. To get a deeper glimpse at the motivations of Canadian

bettors, we sponsored an online study, conducted from September 22 to October 1,2021, surveying a cross-section of more

than 1,000 Canadian adults about their past and future sports-betting and other gaming activities, their sports fandom,

and their consumer-experience preferences. This report summarizes many of the key findings from the recent survey. For further information on the topic, readers are encouraged to reach out to the individuals listed at the end of the report.

Our research clarifies that there are important differences across the Canadian sports-betting community—which means

that a one-size-fits-all approach to promoting wagering is unlikely to deliver optimal results. Instead, organizations should seek to understand what makes different categories of Canadian sports bettors tick—from the events they follow to the ways they bet— and then deliver experiences tailored to the unique expectations and behaviours of each segment.

We hope our research inspires governments, lottery and gaming corporations, private- sector sports-betting operators, casino

owners, media companies, and sports organizations to reevaluate their strategies for reaching and engaging Canadians in

a changing sports and entertainment landscape. The legalization of single-event sports betting represents a significant

and exciting opportunity for the country’s sports, entertainment, and gaming sectors. To capitalize on this opportunity,

organizations in these sectors must take customer preferences into account in order to make intentional, and winning,

strategic choices.

Understanding Canada’s sports-betting community

Nearly 38% of respondents either placed sports wagers over the past 12 months or are potentially interested in doing so in the future. Yet the country’s sports-betting community isn’t homogenous—so organizations that pursue a one-size- fits-all approach to promoting single-event betting are unlikely to achieve the results they desire.

For the purpose of this report, we have segmented the sports-betting community into the

following three distinct persona groups, each with unique betting, sports-interest, and other

related behaviours:

Ardent bettors

These account for approximately 8.5% of the sports-betting community. Ardent bettors

tend to bet often and for higher stakes, wagering $50 or more on average on a single bet

or, according to our survey respondents, $1,000 or more over the previous 12 months.

The majority identify as male (56.3%) and are aged 44 or younger (68.9%). Ardent bettors

are also slightly more likely to have higher incomes than those in either of the other

two groups.

Casual bettors

Comprising 33% of the sports-gaming market, these participants bet less frequently and

for lower stakes, compared with the ardent group. Casual bettors wager less than $50 on

average on a single bet and placed less than $1,000 in bets over the previous 12 months.

The majority identify as male (58.2%) and skew slightly older than ardent bettors, with just

51% aged 44 or younger.

Potential bettors

This group didn’t place any wagers on sporting events over the previous 12 months—

but they’re open to doing so in light of the changes in sports-betting legislation.

Potential bettors comprise approximately 58.5% of the sports-betting community.

The majority identify as female (57%), are young to middle-aged (25–64 years old),

and tend to have slightly lower incomes than either ardent or casual bettors.

Understanding the expectations and behaviours of ardent, casual, and potential

bettors—and delivering a tailored experience to each group—will be essential if gaming

corporations, media companies, and sports organizations are to maximize engagement

with the sports-betting community overall.

Key insights

Our research provides a range of insights into the behaviours and expectations of Canadian sports bettors overall— and clarifies factors that separate ardent, casual, and potential bettors. Understanding these three groups is the first step to effectively engaging them all.

Most Canadians don’t realize they can now bet on single-game sports Only one in five (19.2%) Canadian adults is aware that single-event sports betting is now legal in the country, though ardent and casual bettors are more likely than potential bettors to know about the recent legislative changes. An interest exists, however, as 37.1% of respondents expressed an eagerness in placing (legal) sports-event wagers. Those who said they were unlikely to do so cited a lack of information and an uncertainty about how betting would work under the new rules. Broadly, there is a need for an education and awareness campaign now

that legislation has passed. For governments, this means making the public aware of the recent legal updates, including how and where to place single-event bets. Additionally, an opportunity exists for lottery corporations, sports-betting operators, media companies, and sports organizations to address this awareness gap by using mechanisms such as short-form media-content series. Unsurprisingly, ardent bettors are most likely to place sports-event wagers now that the relevant legislation has been passed: 54% of respondents in this group said they would definitely do so, compared with 32.2% of casual bettors

and just 7% of potential bettors.

Only one in five (19.2%) Canadian adults is aware that single-event sports betting is now legal in the country

Single-event wagers are popular, but interest in other betting remains solid

Two-thirds (66.8%) of respondents who expressed an interest in placing sports wagers post-legislation were intrigued by single-event stakes, although other forms of betting also piqued their interests. One in three (32.8%) said they’d be eager to place micro bets (i.e., wagers on specific in-game events), live-proposition (prop) bets, and other similar forms of wagering, while one in four (24.9%) would be keen to make parlay bets.

Interestingly, casual bettors are the most likely group to try single-event betting (77.5%, compared with 74.1% of ardent and 60.1% of potential bettors). Ardent bettors, on the other hand, are more likely to place parlay and micro/prop bets (48.2% and 58.8%, respectively) than either casual (40.9% and 50.6%) or potential bettors (12.9% and 19.5%).

Of our respondents:

50% - look for a trusted brand

41.7% - seek rapid win payouts

34.8% - search for the best odds

Interest in online wagers has been rising

The legalization of single-event sports betting may drive an increase in online betting, particularly in ardent and casual bettors, according to our survey. Prospective bettors said they intend to place, on average, 49% of their total sports wagers using websites or betting apps, compared with 45.4% earmarked for retail locations, casinos, or sportsbooks, and 5.6% for other channels.

While all three bettor groups expect to place roughly half of their sports wagers using websites or apps, ardent bettors are almost twice as likely as casual and potential bettors to do so via casinos or sportsbooks (14.5%, 8.4%, and 8.8%, respectively).

Brand, payout speed, and quality odds are what attract bettors

How do bettors choose their platforms and services? Half of our respondents (50%) look for a trusted brand, while 41.7% seek rapid win payouts and 34.8% search for the best odds. That doesn’t mean brands can rest on their laurels,

however: surprisingly, only 12.9% of respondents indicated that prior use of a brand or platform might affect where they

choose to place a future bet. Nor should organizations rely solely on celebrity endorsements: just 9.4% of respondents

would choose a betting platform or service based on the support of a current or former professional athlete.

Beyond the commonality of trusted brands and quick payouts, the leading criteria for betting across the three groups tend to vary. Ardent bettors look for betting-option variety and rewards programs, while casual bettors tend to hunt for the best odds plus betting variety. Meanwhile, potential bettorssearch for welcome bonuses for new players, along with the best odds.

These findings suggest we should be prepared to witness some churn as Ontario’s sports-betting market becomes the first in Canada to embrace a competitive marketplace. They also serve as an early indication that Canadian

lottery organizations in provinces and territories that follow Ontario’s lead may, too, experience initial customer fluctuation and turnover. Operators, then, should invest in getting a better understanding of their customers and delivering elements that add value to their experiences in order to earn both their loyalty and their repeat business.

The legalization of single-event sports betting seems likely to drive stronger interest in sports overall

Adding players’ lounges could benefit sports organizations and venue owners

Asked whether they’d like to see any new, bettor-friendly amenities in the stadiums and arenas they frequent, 39.4% of respondents said they’re fine with theirsports venues as is. Yet, if a new amenity were to be added, 43.6% of respondents said they’d love to see a players’ lounge.

The issue grows more nuanced, however, when specific bettor personas are considered. Nearly two-thirds (65.9%) of the ardent group would like to see players’ lounges added to venues, while 44.7% would welcome sponsorship integration such as unique giveaways and special wager options available only in-venue during games. Among casual bettors, more than half (54.1%) would welcome players’ lounges, with 38.4% being amenable to sponsorship integration. As for potential bettors, nearly half (48%) prefer not to see their venues change, although roughly one-third ultimately would accept the addition of either players’ lounges (34.7%) or sponsorship integration (30.2%). This suggests that venue owners may benefit from creating

niche experiences for ardent bettors— as long as the modifications don’t interfere too much with the traditional

game-day experience for everyone else.

Single-event wagering is likely to affect bettors’ overall interest in sports

The legalization of single-event sports betting seems likely to drive stronger

interest in sports overall. Thirty-two percent of respondents said their interest in following or watching sports would

increase. Specifically, more than half (51.8%) of ardent bettors reported that their interest in following or watching

sports will increase post-legalization— to the tune of an additional three hours

per week.

About 84% of ardent bettors said they’ll definitely or probably play other online casino games through sports-betting sites upon legislative changes

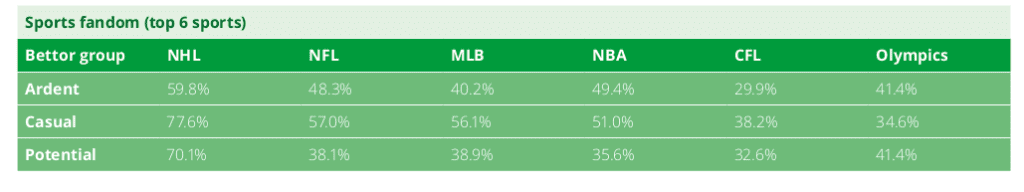

League superfans aren’t super-bettors

Ardent bettors are more likely to be very interested in following sports (60.9%) than casual (55.5%) and potential (35.6%) bettors. They follow more sports too, averaging 6.63 sports leagues on their lists, versus 6.19 for casual and 4.82 for potential bettors. Regardless, ardent group members are less likely than casual bettors to be superfans of any one league.

In terms of post-legislation betting, those who are superfans of the NHL, NFL, MLB, NBA, CFL, or the Olympics tend to wager

less frequently and in smaller amounts. Those who bet more often and make larger wagers, conversely, show interest in organizations and sports beyond those in the top North American leagues— including women’s sports leagues and the

video-game/e-sports sector.

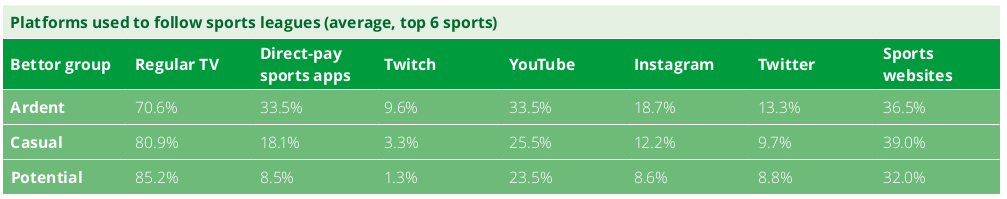

Ardent bettors respond to digital channels

The sports-betting community follows sports in multiple ways—organizations eager to promote their products to this crowd should focus their efforts appropriately.

While casual and potential bettors follow their target sports on television (81% and 85%, respectively), ardent bettors—who

track a wider variety of sports, bet more often, and wager higher amounts—are much more likely to use digital channels

as well as TV, including over-the-top (OTT) media services (which stream directly over the internet) and social media.

Organizations that rely on television alone for advertisements and engagement may miss important opportunities to reach

one of their most substantial markets.

Sports betting can be an effective entry point for other, more established gaming options

About 84% of ardent bettors said they’ll definitely or probably play other online casino games through sports-betting sites upon legislative changes, whereas 75% of the casual crowd will do the same. Potential bettors, however, aren’t as sure,

with just 40.8% definitely or probably taking part.

Wagering might pick up, however, once bettors visit casino sportsbooks post-legislation. More than three-quarters (78.1%) of ardent bettors said they’ll definitely or probably play other casino games under these circumstances, while slightly more (83.4%) casual bettors will definitely or probably do so. Even potential bettors are relatively more inclined to linger at casino sportsbooks, with 54.1% definitely or probably playing other games. For online gaming providers and casino operators alike, capitalizing on this heightened interest could be a significant opportunity to drive revenues.

Playing to win in Canada’s evolving betting scene

The legalization of single-event sports betting has introduced significant new opportunities for organizations involved in Canada’s sports, entertainment, and gaming sectors. But how can lottery and gaming corporations, private-sector sports-betting operators, casinos, media companies, and sports organizations seize these new opportunities effectively in a dynamic, competitive industry? The answers lie in understanding who their customers are so that they can deliver experiences and product mixes tailored to the unique behaviours and expectations of each client group.

Winning with ardent bettors

Ardent bettors follow many sports, are eager to bet—and bet often—using a variety of digital channels, and seek unique experiences. Accordingly, lotteries and private-sector sports- betting operators should focus on defining and delivering on omnichannel brand promises that include many betting possibilities, quick payouts, and compelling VIP rewards. Casino

owners/operators should consider placing exclusive sports-betting lounges and kiosks near table games—among

other options aimed at increasing engagement—to capitalize on this bettor group’s craving for action.

Media organizations should aim to integrate betting into the broadcast or direct-to-consumer viewing experience, including through gamification, online- betting shoulder content, and “betcasts”. Additional options to consider include delivery through social and OTT channels featuring sports rights and accompanying content for sporting events beyond those of the Olympics and major North American professional leagues. Moreover, sports teams should provide free-to-play games to engage ardent bettors virtually, and should offer specialized players’ lounges and mobile sportsbooks inside

their sports venues.

Winning with casual bettors

Casual bettors tend to be sports fans first, bettors second. They like to wager, but they don’t want betting to interfere with their sports enjoyment. Lotteries and private-sector sports-betting operators should focus on offering quick payouts, competitive odds, and a variety of betting options, and prioritize making betting available via lottery kiosks. Casinos should appeal to casual bettors’ love of their favourite sports by offering cross- promotional prizes and sports-themed casino games—e.g., poker players could win VIP tickets to NBA games or take their lucky shots with basketball-themed slot machines.

Media organizations should offer betting content through means that don’t distract from the games themselves

(e.g., separate feeds for bettors) and lean in to the social experience of wagering, such as providing easily understood and

various fun bets (e.g., player prop bets) that connect bettor viewers with other fans. Sports teams can work with their

betting partners to build awareness of single-event sports-betting options while promoting responsible gaming behaviour,

and provide free-to-play games that can educate and engage bettors, attract new customers, and glean valuable customer

data for teams and betting partners alike.

Winning with potential bettors

Potential bettors need to know more about single-event sports betting, from how it works to the kinds of bets that can be made. Organizations that take time to explain and educate will make inroads into this market segment. Lotteries and private-sector sports-betting operators should focus on delivering on brand promises of attractive welcome packages, competitive odds, and quick payouts. Casinos should promote sportsbooks in their entrance areas, provide educational materials about sports-betting options, offer welcome bonuses to patrons who are first-time sports bettors, and provide a comprehensive user experience that includes sports entertainment, traditional table games, and other such activities. Media organizations should focus on easing these bettors into wagering, such as by offering casual free-to-play or one-off, low-risk contests to pique their interest. Additionally, sports teams should strive to keep mass sports-betting integration to a minimum to avoid turning this group off.

A more nuanced understanding of bettors can mean everybody wins

The legalization of single-event sports betting is one of the most significant developments the Canadian sports,entertainment,

and gaming sectors have seen in years. Maximizing this opportunity necessitates that industry players truly understand

the unique expectations and behaviours of the different types of Canadian sports bettors—and then deliver the kinds of tailored experiences and betting options that can attract, capture, and excite each group. Providing a personalized approach that reflects how Canadian bettors like to follow and engage with their favourite sports, as well as how they like to wager, can greatly improve organizations’ odds of winning in this new landscape.